The Folly of Home Ownership as an Investment

PSST

I’ve got a hot investment tip for you.

Interested?

Good.

Here’s the deal: First off, it’s tied to supply and demand characteristics of a singular small geographical area, so it’s very highly… focused (let’s not use annoying terms like “undiversified”). Speaking of “focused”, each share of this asset will likely account for the majority of your entire portfolio. Its value can be negatively impacted in radical ways by choices your neighbors make. Decisions made by the government, from the federal level down to a neighborhood associations, will also play an outsized role in its growth potential. Ownership of the asset will give you financial incentive to fight the poor (via affordable housing) and private and public organizations supporting these folks (such as homeless shelters, rehabilitation clinics, and that church that’s running a food pantry). You’ll become emotionally attached to this asset, too, and any attempt to separate its role as a financial instrument from its emotional role will be difficult. Ownership of this asset will make moving for any reason (like a higher paying job) even tougher. Oh, and if you’re like most people, you’ll end up borrowing huge sums of money to buy the asset – general wisdom calls a 4:1 leverage ratio prudent, though the government will help you boost that ratio to 28:1 if you haven’t bought the asset previously.

Still interested?

I’m talking, of course, about home ownership.

Finances and home ownership have a tricky relationship. So before you curse at me and close the tab, I’ll explain what I’m not saying.

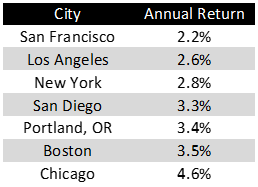

I’m not saying that home ownership can’t make financial sense. If we think about it as an asset, a home does produce “income”- the income produced by a home can be thought of as the amount you’d pay in rent each year. In New York, for instance, an apartment that rents for $1,000 a month sells for, on average, $427,800. Thus, we can think of the average home in NYC as being similar to a bond paying 2.8% per year, before principal appreciation. Here’s a table showing that average return for a few different cities:

In lots of big coastal cities the return is actually lower than mortgage rates. This is one of many explanations for why so many people rent in cities. However, these returns actually improve with time due to inflation. While the principal investment doesn’t change over time, the implied income (what you’d pay per month for an equivalent home) does increase. Broadly speaking, that’s why it generally makes more sense from a financial perspective to own your home if you’re planning to live in it for a long time than if you’ll stay only a few years. That logic is roughly borne out in the NYT tool you may have seen a while back. Home ownership also provides a buffer against rent-hikes, an enormous psychological benefit, especially for older folks on a fixed income (of course, as I wrote about when discussing historic preservation districts, home owners are still subject to higher property taxes as the values of their homes rise). But these implied income numbers are small, and only get smaller when you account for the fact that renters are generally not responsible for repairs, maintenance, yard work, or most of the other upkeep associated with home ownership. What’s more, the numbers assume outright ownership without a mortgage.

I’m also not saying that home ownership is a bad thing generally. Many people would choose to own their own home even if they realized that ownership is generally more expensive than renting – they receive positive benefits from ownership (pride, freedom to remodel or make changes, etc.) that are worth paying more for. What’s more, many neighborhoods restrict rentals, which means that “equivalent homes” is often a myth; one couldn’t find an equivalent home even if she did want to rent.

Finally, since someone will no doubt make this argument: yes, studies do show that home owners tend to participate more in their communities than renters. However, since most people aspire to home ownership, this could be almost entirely explained by the relative stability of renters versus owners. In places where renting is more common and there are fewer differences in income, age, and education between renters and owners, these differences in “civic participation” disappear. The civic participation argument has mostly been disproved as the racist propaganda that it is.

Phew. Okay. So that’s what I’m not saying. And to be transparent, I’m reasonably ambivalent about home ownership myself. While not having to worry about my plumbing or shoveling my stoop is nice right now, I won’t be surprised if at some point I decide that I’m willing to pay more money to own than I am to rent – but this won’t ever be a financial decision.

What I am talking about are people who, understandably, think of their homes as a good investment for capital investment. In the United States, we’ve completely mythologized home ownership since the late nineteenth century. From FDR’s a “nation of homeowners is unconquerable”, to William Levitt’s completely-serious “[n]o man who owns his own house and lot can be a Communist. He has too much to do”, to the mortgage-interest tax deduction (which, say it with me, costs the United States more than all public housing programs and goes overwhelmingly to the rich), the idea of owning one’s own land is part of our national identity. It’s no surprise that, in order to rationalize this mythology, we’ve told ourselves that it’s a financially prudent choice.

While the first paragraph above tried to poke fun at all the reasons why home ownership is a bad investment for principal appreciation, it’s worth spending a few serious moments with. If you follow financial trends at all, you’ll know that there’s been an explosion in index funds since the Great Recession. Why’s that? People are finally realizing that the key to a financial portfolio is diversification. People are buy these funds that track, say, the S&P 500 precisely because they give them exposure to the entire market. Rather than be loaded up in just tech stocks or just companies in Florida, individual investors are learning that spreading assets out (even within a single sector) leads, mathematically speaking, to lower risk without concomitant decreased expected reward.

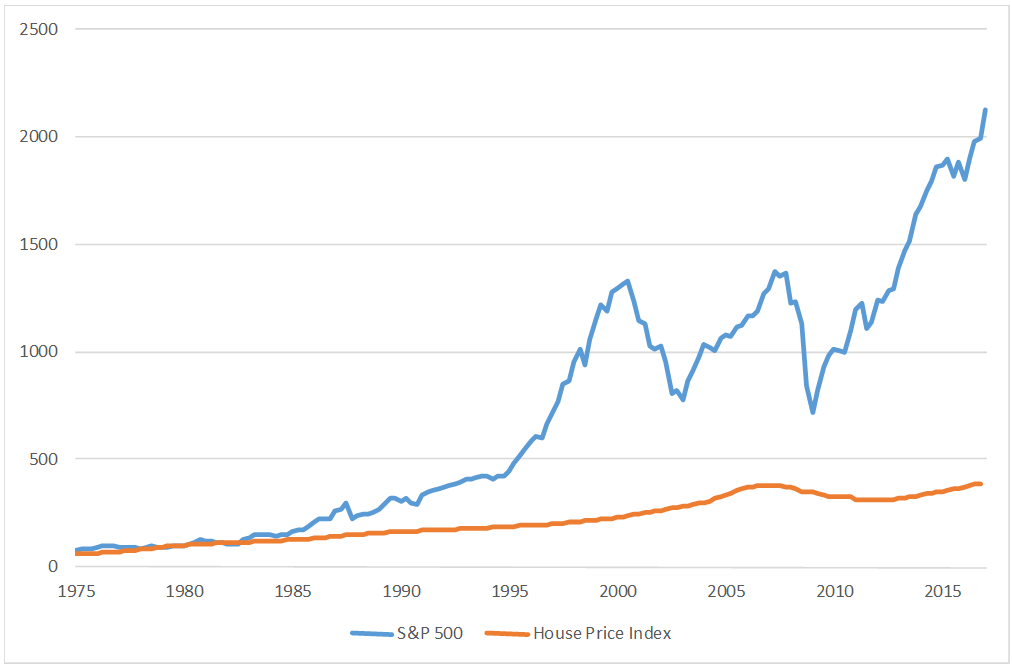

Aside from the very wealthiest households, homes now represent more than 50% of holdings for American families. One single home, in one single neighborhood, subject to the economy of one single region. And we’re still being told that it’s a good financial investment. However, the raw numbers show that average house prices haven’t gone up anywhere near as quickly as the S&P 500 over the past 40 years:

Of course, the odds of hitting that orange line exactly were next-to-none. Home owners either vastly exceeded or vastly undershot that orange line because of all the issues of non-diversification discussed above. The orange line above shows what a portfolio perfectly allocated among all homes in the United States would have done – not the incredibly undiversified portfolio including precisely one (or maybe two) homes. That said, even the average of all of home buyers in 1980 saw their down payments grow by only 20% of what the S&P 500 would have returned (with dividends reinvested). This does, of course, ignore the “implied income” discussed earlier, but even when we add that in, the numbers aren’t close.

At a macro level, why does this matter? Last month, the Upshot had a really excellent piece on what would happen if Americans stopped thinking of housing as an investment, but rather thought of it as any other consumable good. In the piece, they review a recent paper by economists Joe Gyourko and (you knew this was coming) Ed Glaeser. The paper is great, too, but I’m told I have a higher tolerance for academic economics than most people. Their central thesis is that if we stopped thinking of homes as investments and thought of them as service-providers, home values would probably come down. While this would understandably upset folks who have bought into the notion of housing an investment, it would provide a massive shot in the arm for the economy as a whole – they estimate that it could increase domestic product by roughly 10%. This is due, in large part, to an increase in labor force mobility (people aren’t as geographically constrained and can move to where they would be more productive and thereby receive higher wages) and the shift in capital away from a relatively unproductive asset (housing) into the stock market where it would be put to more dynamic use.

There are many reasons why home ownership can be a rational decision for an individual. Homes are never just a financial asset – they form the center of most of our lives, and are rightly bound up in our sense of self, our familial identity, and our connections to our communities. However, our personal finances and, to a large extent, our national economy would be well served if we thought more clearly about the costs we pay, not the money we save, to own our own homes.