Federal Policy and Racial Inequity (Part 2)

This is the second of two parts on housing policy and structural wealth inequalities in the United States. Last week I wrote about the history of redlining and contract selling. Today we’ll explore how the systematic exclusion from the housing market in the last century has translated into wealth inequalities in this century.

“Aha!”, you’re saying. “You’re contradicting yourself! A few months ago you wrote about how bad home ownership is as an investment, and now you’re complaining that Black families are locked out of it. In that case, aren’t they being protected (if also patronized) by being shielded from getting duped into home ownership?”

There are, however, a few caveats to that analysis because of the ways in which the United States has historically used the tax code to encourage home ownership; namely, the mortgage interest deduction (MID) and the lack of taxes paid on imputed rent. Despite the fact that encouraging home ownership is bad public policy, the United States has consistently used public money to help certain groups buy their own homes. Talking about the tax code seems boring, I know. But if we’re going to understand how policy has systematically undermined minorities in the United States, we need to look at the systems themselves.

- Mortgage interest deduction allows home owners to deduct the interest paid on their mortgages from their taxable income. This is the single largest loop-hole in the United States’ tax code – its annual cost to the treasury is north of $70 billion a year and 77% of the benefits in 2012 went to homeowners making more than $100,000 a year. That’s more than all other federal housing subsidies combined. The amount going to those making above $100K a year is almost identical to the value of all other programs. In the US, we give as much public housing assistance to people making six figure salaries as we do to everyone else. Let that sink in for a second. Seriously, stop reading for a minute, and actually consider the fact that, behind Social Security and Medicare, MID is single largest entitlement program in the country. If you’re like most people, you wouldn’t ever think of this as a government handout – but it is.

- The second point, lack of taxes paid on imputed rent, is of equally large proportions but gets even less attention. If an individual rents their home out, they pay taxes on the income they receive. While it’s a little wonky to think of it this way, from an economic perspective there’s no reason a homeowner shouldn’t pay taxes on the rent they essentially pay themselves. Though often unnoticed (and difficult to quantify without a firm would-rent-for number), this is an enormous tax break for home owners vis-à-vis their renting counterparts.

- There’s also a psychological aspect to home ownership and wealth. When the national savings rate is less than 6%, mortgages often serve as a commitment devise to ensure saving. Most home owners aren’t facing a real choice between buying or renting and investing the difference; they choose between buying and accruing equity or renting and spending what they save there somewhere else. “Saving” via a mortgage is clearly better than not saving at all.

Matthew Desmond sums it up: “It is difficult to think of another social policy that more successfully multiplies America’s inequality in such a sweeping fashion.” He goes on to note, “A 15-story public housing tower and a mortgaged suburban home are both government-subsidized, but only one looks (and feels) that way.” You know what? Go read his article in the Times last week. And then read his book Evicted. Then call my brother, a rising star in social equity conversations in Milwaukee, WI (where the book is set) and he’ll tell you even more.

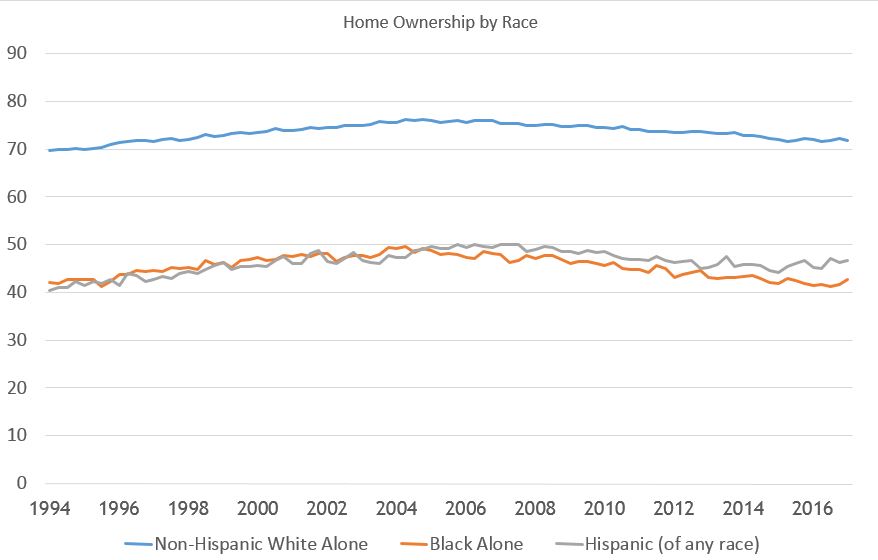

We’ve discussed how all these different policies could impact home ownership rates of different races, but do they actually? Redlining ended two generations ago – are there really still lingering impacts in home ownership rates between races? While there’s a lot going into this chart, to say that none of this has to do with systemic bias in our policy would be laughable:

The census data this pulls from makes it clear that this trend is present in every state. Whites are consistently nearly 50% more likely to live in homes they own than Blacks or Latinos. And lest we think that these policies targeting Black home owners went by the wayside in the last century, we need only look at evidence from the foreclosure crisis a decade ago. Banks such as Wells Fargo explicitly targeted Black and minority families for mortgages lenders knew were bad leading up to the crisis. We only need to look at the Wells Fargo emails, in which they discussed strategies for issuing “ghetto loans to mud people”, to know that the housing market continues to be biased against people of color.

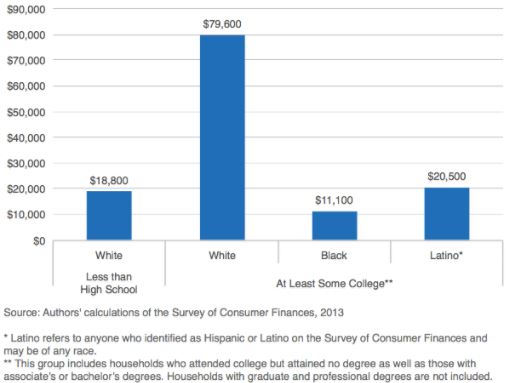

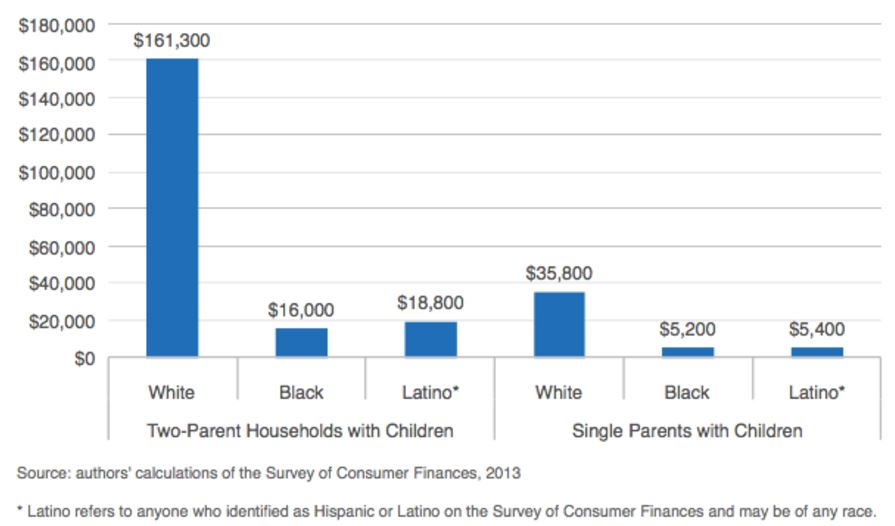

And this disparity in home ownership rates has real impacts on wealth accumulation. As Melvin Oliver and Thomas Shapiro pointed out way back in 1995, the wealth gap is far, far more important for understanding systemic inequality than the income gap. Wealth dictates the risks a family can take, the stability offered when a job is lost, the ability to invest in higher education, and countless other decisions. Even when we control for various socioeconomic factors, an enormous wealth gap between Black and White families emerges:

(Of course, none of this really matters anyways. As Matt Bruenig pointed out last week, the appreciation of Black owned homes hasn’t come anywhere close to matching the appreciation of White owned homes. Why? Because White dominated neighborhoods are more desirable, of course! We associate white neighborhoods (rightly or wrongly) with better schools, lower crime, and better public investment. As long as we continue to under-invest in Black neighborhoods, fixing the disparity in home ownership will only have small positive impacts.)

Okay. So we’ve explored how policies from 75 years ago have had lasting impacts on inequality and wealth distribution in this country. And we know that, despite the origins of the discrepancy in home ownership rates we have policies in place that give massive rewards to home owners. It’s not hard to see, then, that home owners are today enjoying the fruits of a racist system. This is not to say that they themselves are racist, but rather that they benefit from a system that was, at its outset, explicitly intended to help whites and exclude blacks. If you’ve never really understood “white privilege”, systemic racism, and how a system alive and working today can continue to marginalize folks of color without most people being actively racist, hopefully this has helped you grasp that a little more clearly. There are plenty of white, middle class home owners who may not have any animosity towards people of color, and simply haven’t realized that they benefit from a program explicitly set up to help them more than other people.

What do we do about it?

First, we demand that our politicians have an honest debate about this. Despite Trump’s and the Republicans’ talk about a major tax overhaul, eliminating loopholes, and simplifying the tax code, Steve Mnuchin has made it clear that they won’t be touching the mortgage interest deduction. Let’s ask our elected officials why we can cut Meals on Wheels but we can’t touch a loophole that goes overwhelmingly to the wealthy. We know the answer: taking the MID away would mean impacting a voting block that has resources to summon and has a strong voice in the political process; poorer people don’t have the ear of politicians quite like those families making over $100K.

Secondly, we could refuse to deduct the interest paid on our mortgages from our taxes. That way, we wouldn’t be benefiting from the systemic bias in favor of people who can afford homes, right? Let’s call this Level One Awareness. Sure, we can reject the bias in our favor, and that’s a good place to start. But simply not partaking in advantages given to us doesn’t actually change the system; that extra tax we pay just goes into the general fund. It’s not bad to reject privilege, but we can use privilege to actively fight itself.

What if we actually used the money we save from the mortgage interest deduction to fight the system itself? What if we did deduct the interest, and then used the money we didn’t have to pay in taxes to support affordable housing? To donate to a homeless shelter, or organizations fighting for tenants rights? Or a politician vowing to end this loophole? What if, rather than leave our privilege on the table, we claim that privilege and then transfer the benefits to those who have been systematically excluded?

This is, of course, a big commitment to make. Expecting the tax break goes into the financial decision to buy a house, and to walk away from that is tough. But here’s my challenge to you, home owners and mortgage-interest-deducting readers: start small. You probably recently got your tax refund; why not figure out what the loophole was worth to you, and donate 10% of it to a worthy organization? Maybe 20% even? If you’ve heard the conversations about systemic bias and structural inequality but haven’t really known how to start fighting it, or didn’t get how it related to you, you can’t use that excuse anymore. And look, I’ve already started helping you find a great organization!