Modern Housing for America

Before I took off for Peru this summer I picked up Gail Radford’s Modern Housing for America from the NYU library. Since NYU lets me check out books for like 4 months at a time and I had other books from the regular library, I didn’t get to it until recently. For the housing nerds in the audience, it’s a great read on the discussions that were happening in the 1920s and 1930s about the role of the federal government in the housing market. We know how the story ends: the mortgage interest deduction (MID) makes home-ownership cheaper by reducing the tax burden of buyers. Because this policy is used to decrease the cost of ownership and not overall housing costs, its benefits are enjoyed almost completely by people who are rich enough to own their own home. The MID is the third biggest federal expense, right behind Social Security and Medicare. When you have a federal program that costs $100 billion a year where 77% of the benefits go to families making more than $100,000, you’ve got a program that makes inequality much worse. It’s worth noting that despite being hailed as the “most sweeping tax overhaul in decades”, Trump’s plan which was released today is silent on reforming the MID. City Observatory has a great piece from last week looking at how housing policy has increased inequality – go read it!

Fun fact of the day: The typical homeowner is roughly 100 times wealthier than the typical renter. https://t.co/YhsfPUJr6S

— City Observatory (@CityObs) September 22, 2017

Radford’s book takes us back 100 years to before when the MID was so enshrined in the federal tax code that most people forget about just how big this welfare program is. In the early 1900s there were a whole bunch of different things happening that were leading major shifts in housing. One of the biggest was the development of better housing. Between 1880 and 1920 people’s expectations about what a house would look like changed. Suddenly, all these uppity Americans wanted such luxuries as being able to use an INDOOR TOILET and – wait for it – HEAT. A few years later a fad known as “electricity” swept the nation, and suddenly folks expected that in new homes, too. These advances, while obviously welcome, made the cost of new homes go way up.

New laws and regulations, like New York’s 1901 Tenement Act, also inadvertently drove up the cost of new housing. These building codes ensured that new buildings would provide tenants with access to light and air, and enforced minimum fire safety standards. While they were successful in providing a higher-quality housing stock, these new buildings obviously cost more – and were more expensive to rent.

A third major factor in the steep rise in housing prices was how new construction was financed. Prior to the 1900s people would borrow money from family members. Generally, housing wasn’t financed the way that it is today. Individuals could sometimes get small loans from financial institutions, but the buyer would have to put down at least 50% in most cases. However, as more people started saving money in banks and their local building and loan society (yes, like George Bailey), these financial institutions started to finance more developers. As developers started to rely more heavily on financing from banks, rather than individuals, to build their projects, they had to focus on construction with the highest possible profit. Previously, individuals or small potential landlords paid someone to build them a house and would pay the going wage. As more and more people started investing in capital markets, however, money flowed to the companies with the highest return – inevitably, those building at the high end of the market.

So in the beginning of the 20th century, we’ve got this perfect storm coming together for housing – tastes and laws are pushing up the cost (and value) of buildings, even as changes in capital flows and financing cause construction to concentrate at the high end of the market. Enter World War I, and things get even worse as the war effort sucks up materials, labor, and capital through war bonds. The result is that by the 1920s, average housing costs have gone up significantly more than average wages. Once the Depression hits, everything goes to shit.

So what do you do in this situation? The federal government sees that, structurally, the free market isn’t able to provide adequate housing for most people in the country. Costs are rising, attempts to bring the efficiencies of Ford’s assembly line to housing construction have failed, and land speculation is rampant. Congress has been convinced that housing is a social good and that the country will be better off if the government can make sure people can afford a home. You’ve got to change the market dynamic somehow – how do you choose to do it?

Radford lays out the argument that ultimately lost: basically, that the profit motive in the market for land makes everything wacky. In most markets the profit motive works fine, within reason. I buy a bunch of materials for as cheaply as I can, make something great (a meal, a table, a car), and sell it for as much as I can. When you invest in most companies, you’re helping someone else buy the materials, and then getting a share of the profits they make at the end of the day. But what happens when you invest in property? Despite the fact that we today think of them similarly, investing in land is a totally different thing. You’re not bankrolling a company that’s able to efficiently deliver a product but rather placing a bet that someone in the future will want the land more than you do. It’s speculation, not investment.

Let’s think about this using an example. Let’s say you buy a house somewhere in a middle-of-the-road neighborhood. You keep up with regular maintenance, and you watch as the value of your home rises in line with inflation. Then, suddenly, the neighborhood becomes unpopular (or popular). As people want to move out (in), the value of your property goes down (up). The characteristics of what you own haven’t changed. Your home is still the same quality and can fit the same number of people. Your yard is the same size. There’s nothing you’ve done to make the value of your property go down (up) – so why should you suffer (benefit)? The value of your land is due to what goes on around you – it’s socially created.

Worse, when homeowners are invested in the land and not just the structure, all sorts of weird and wacky incentives show up. For instance, from Econ 101 we know that when supply is low, prices are high. Lots and lots and lots of people want to live in Greenwich Village in Manhattan, but there aren’t many homes there so prices are super high. It would be better for everyone in the city if there were more units in the neighborhood… better for everyone except for the current owners, that is, because it would lower prices. Homeowners are a cartel – joint monopoly owners of a finite resource in a given area. Investment in a scarce good in high demand makes for some really nasty NIMBYism.

There’s a long tradition of economists (most notably this dapper gentleman, Henry George) who argue that the value of the land should belong to everyone in society because it’s created by everyone in society. If you remodel your kitchen or add a swimming pool or make your place better somehow, you should get to keep any value that you create. But if the value of your land drops way down or shoots way up, the whole community should share that cost or share that benefit. This isn’t incompatible with land ownership, or at least not any more than homeowners associations and zoning codes are. It’s also not a subversion of a free market because a free market doesn’t exist when we’re talking about land. It’s not like new competitors can enter into a neighborhood – the amount of land is unchangeable.

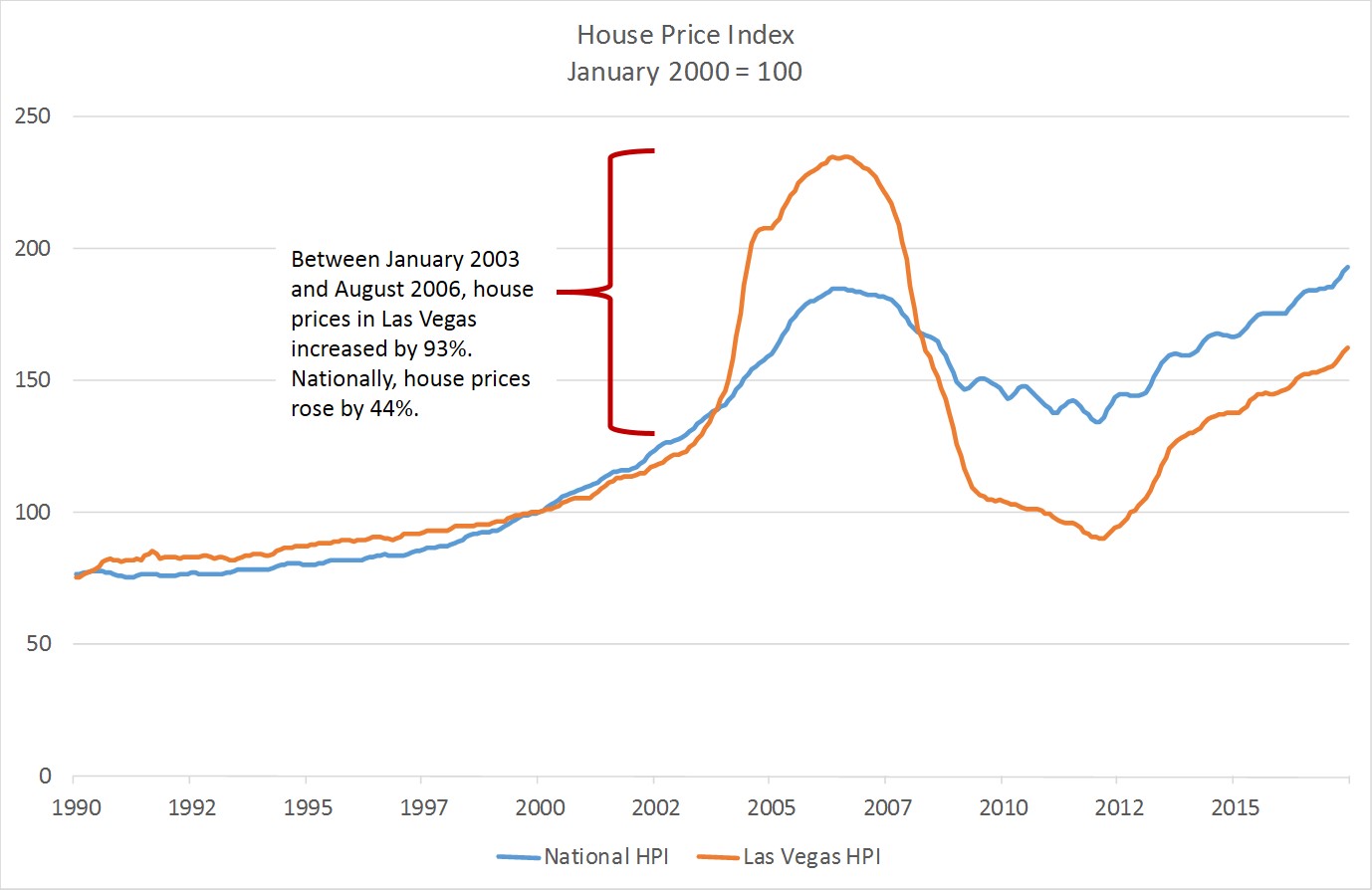

A decade ago, we saw what happens when speculation enters the housing market. In the space of just three and a half years, national home prices increased by nearly 50%. Some places, like Las Vegas, saw house prices nearly double. That’s not supply and demand for value taking place, but rather sheer speculation. At the time, we weren’t calling this a crisis. We were celebrating our good fortune.

As Henry Brean at Las Vegas Review-Journal wrote, “Mostly what we lost was money – almost $113 billion of it, according to a rough estimate by a top real estate expert at the University of Nevada, Las Vegas. But the sharp drop in housing values also wiped out tens of thousands of jobs in construction, real estate, finance and related fields. Houses were lost, college funds erased, retirement plans scuttled.” Land speculation turned 18% of our GDP into a giant pyramid scheme. Earlier this year, the Upshot ran a piece looking at the economic costs of speculation in the real estate market. They calculated that our treatment of housing as an investment, rather than a service we pay for, costs the United States’ economy around $1.5 trillion each year. This impact is worst precisely in the places where people most want to live. Current homeowners fight against allowing new building, rightly understanding that by constricting new construction they can artificially prop up the value of their own homes.

Modern Housing for America takes us through some of the possible ways that we could have structured federal policy in such a way that it got us away from land speculation. And indeed, some of the New Deal programs did just that. The Public Works Administration, for instance, built some 21,000 units of middle-income housing. Significantly, when the federal government was considering these programs, they weren’t directed at the poorest families. Rather, they were basing their housing programs on what was happening in Europe where governments were building housing for large swaths of the population. These homes were not intended to be for families who couldn’t afford to house themselves but were rather an attempt to remove the profit motive from housing. Housing was (and still is, in many European countries) treated much like a public utility.

Another tactic explored was the use of limited-dividend companies. Under such a scheme, the government would give grants to private developers or lend them money on favorable terms. In return for easy access to credit, developers would be held to stringent requirements on rents, rules for sale, and quality of building. This sort of a policy would have encouraged builders not to build the units for which the highest profit margins were possible, but rather the types of homes that are the most economically efficient – townhouses and three to four story buildings, precisely the type of building we don’t see now. This is not only the most economically efficient (cheapest per unit, for a given level of quality), it is also dense enough to support mass transit and walkable neighborhoods and sparse enough to allow light and air. In Vienna, this type of housing predominates. Not only is it significantly denser than, say, Seattle – it also has more than four times the green space. Less expensive housing, walkable neighborhoods, and a city where a full 50% is parks? Sign me up.

Of course, the mortgage interest deduction doesn’t subsidize building but rather buying. This can stimulate some building, but it actually distorts the market much more than directly subsidizing building would be. As we talked about before, if we subsidized building, the market would just produce more of what makes the most economic sense. We’d see dense, walkable neighborhoods where housing costs are way lower than they are now. By subsidizing buying, though, the market ends up producing not more of what makes the most economic sense. It ends up constructing more of what one subset of consumers wants – those who can buy. Rather than broadly subsidizing the entire industry, it makes buying relatively cheaper than renting. And when people own, they generally want to own single-family homes, because ownership in a shared condo or co-op building can be a headache. So this welfare program that goes mostly to the wealthy and not at all to the folks who are unable or don’t want to buy a home actually causes an overproduction of inefficient housing.

Anyways, I’d highly suggest Modern Housing for America, even if you’re somehow really gung-ho about how we do housing policy in America. Most of what we take for granted – “Homeownership is good for society and we should use public money to encourage it” – didn’t come from any sociological studies or reasoned public conversation at all. It came out of some powerful lobbying groups who wanted to get Americans to pay more for their housing than they needed to. Much like the “tradition” of engagement rings can be traced directly to an advertising campaign from the De Beers diamond company in 1938, much of the powerful myth of the goods of home ownership just kind of came about because of some weird historical trends. We can still choose to subsidize home and land at the expense of renters. It’s a policy that disproportionately hurts the poor, has enormous implications for education, access to jobs, and enfranchisement for minority communities, and completely wrecked our economy in 2008, but I guess it could be defended by someone. But it’s a policy that we should demand is defended on its own merits, not just through some appeal to “It’s the American way.” It wasn’t the American way before the 1930s, it isn’t a system that inherently supports the free-market or property rights, and there’s no reason that it has to stay that way.