Household Wealth in the SCF

The Federal Reserve Bank’s 2016 Survey of Consumer Finances data was released recently, and a few things in it caught my eye as I was playing around with it.

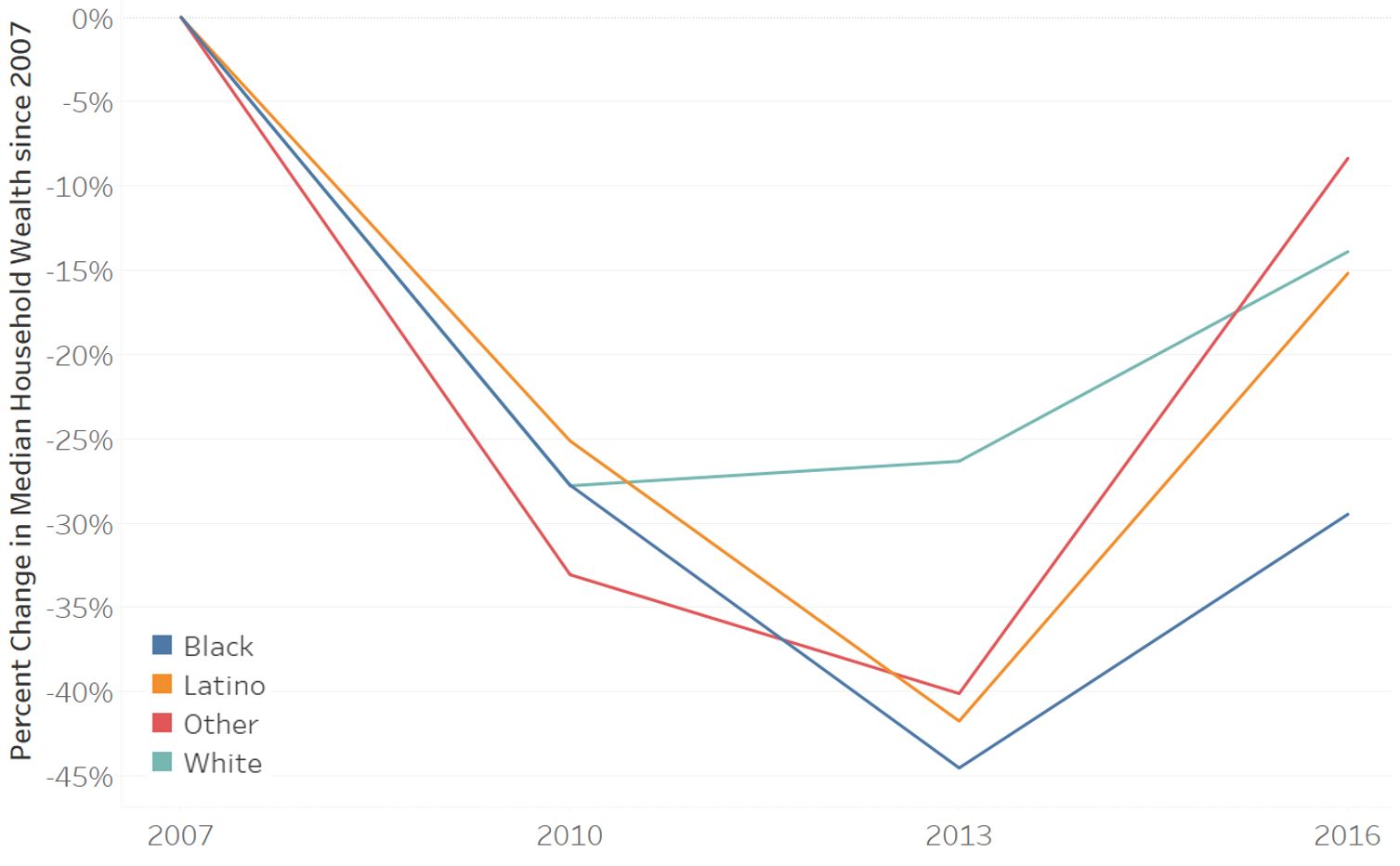

First, a bit of good(ish) news: since 2013, the median household across all racial groups have seen their wealth increase fairly substantially. The data is collected every three years, so it’s tough to know exactly what happened in the years in between. That said, unsurprisingly every racial group saw their median wealth shrink between 2007 and 2010, and wealth continued to drop for every racial group aside from white families between 2010 and 2013. Between 2013 and 2016, however, this trend reversed. This is, however, at best a mitigated win. The median household wealth for every racial group is still well below where it was in 2007 before the housing crisis:

These gains between 2013 and 2016 were particularly impressive for Latino families. When the 2013 data came out, many commentators noted that the recovery in household wealth was concentrated among white families, while all other groups continued to suffer. Between 2013 and 2016, however, household wealth for Latinos grew so rapidly that they are now only slightly more worse off (with respect to where they were before the recession) than white families. The same can’t be said for black families, despite the fact that their household wealth did increase over the past three years. The median black household today has 30% less wealth than they did in 2007, while the median white household’s wealth has declined by 15%.

Of course, these different groups didn’t start off from the same place even in 2007, meaning that these disparities are compounding across time. In 2007, the median white household had about $8 in wealth for every $1 that black households did. Today, although white families are worse off than they were before the recession, they have $9.94 for every $1 that black households do. So, despite the good news that black household wealth grew over the past three years, the fact remains that racial wealth inequalities grew by nearly 25% over the past 10 years:

We know this story: black and Latino families live in neighborhoods that were hardest hit and that have taken the longest to bounce back. While the recession obviously was disastrous to neighborhoods and families all around the country, it wasn’t evenly distributed among the different communities. It should come as no surprise that it hit poorer communities harder, and that the last ten years have therefore increased racial inequality.

As we move on, remember: we started with the good-news part of the post showing that all racial groups increased their household wealth between 2013 and 2016.

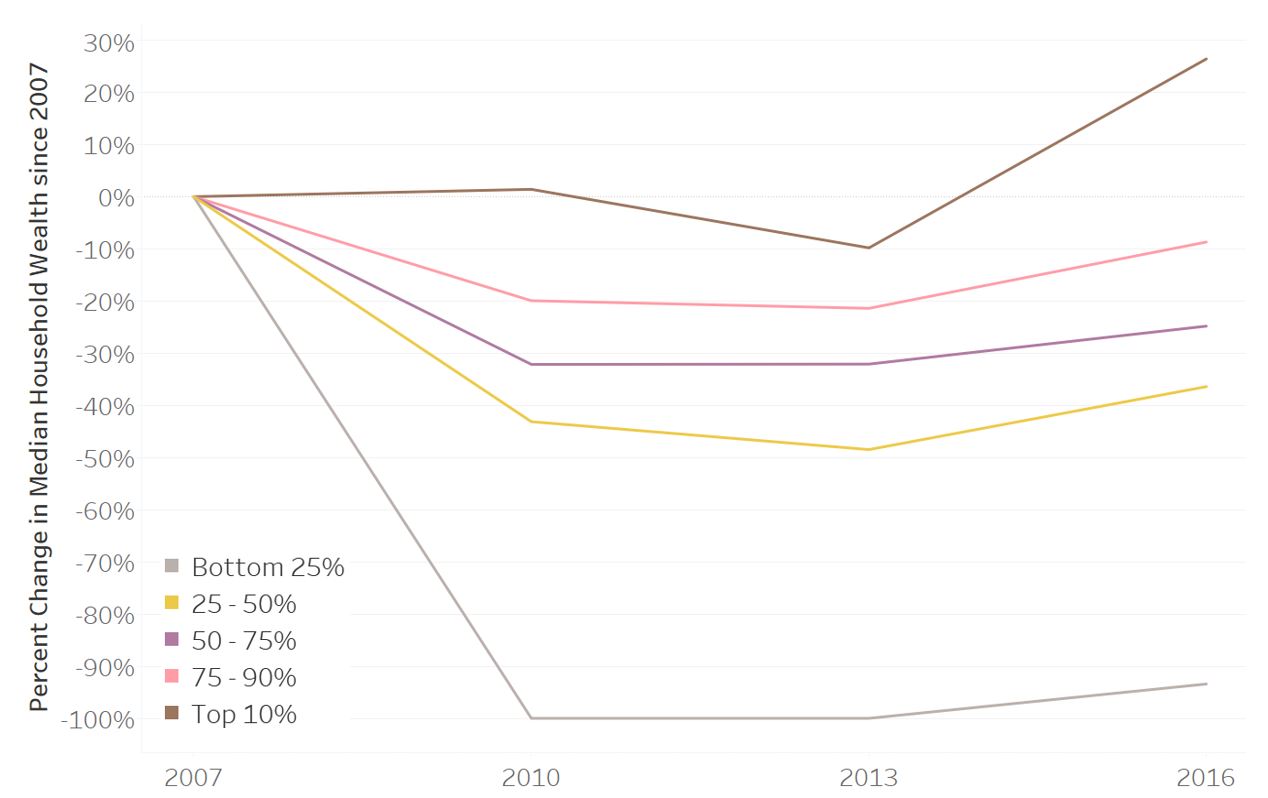

The bad news is how, within racial groups, that growth was distributed. If you’re in the top 10% of the wealth distribution, congratulations! Not only did you have $3.8 million in 2007, that number has grown by 30% since then! You’re probably feeling pretty good about the $4.5 million you’ve got now. If you’re in the other 75% of the distribution you’ve got about $225 thousand dollars now. You’ve been less lucky: if you aren’t in the top 10%, you’re wealth still isn’t back to where it was in 2007. The data here are damning. If we were moving toward a more equal country, the poorest would see their wealth growing more quickly than the rich. In reality the precise opposite is happening: the less you had in 2007, the more you’ve lost since then:

The mean household wealth for the bottom 25% of the wealth distribution now owes $12,000 more than they own, and the mean for the bottom half is just $16,000 – down an astonishing 50% in the last ten years.

That’s right.

In 2007, the bottom half of the wealth distribution had a net worth of $32k, and that number has shrunk to $16.

The new SCF data paint a pretty bleak picture. White families and wealthy families are increasing their household wealth even as the groups that started out at a disadvantage are falling further behind. As Congress contemplates what they’re going to do with the tax code, these numbers are worth keeping in mind. I’ve been thinking in particular about the proposal to drastically lower the cap on traditional 401(k) contributions. The goal here is to finance tax cuts that will overwhelmingly benefit the wealthy. But here’s the deal: gutting a program that incentivizes people who may not be able to afford retirement to benefit the wealthy doesn’t make a damn bit of sense. Not only did the wealthy obviously start out ahead – they’re also the only group who is better off today than they were before the recession. So why are we trying to help the people whose benefits have compounded over the past decade at the expense of people who’ve lost wealth over the same period?