Resiliency Planning in the Fragmented Metropolis

One of the very first posts I wrote on the blog last winter looked at a school district outside of El Paso, Texas, that was trying to block the construction of public housing. They argued that kids from families poor enough to live in public housing would be too costly to educate. In the piece, I argued that this is the result of having political power split among lots of different municipalities at the metropolitan level. I came back to the idea earlier in the summer when I talked about how everybody loses when different local governments compete with one another for wealthy residents. It happens all over the country: suburbanites outside Boston can impede the improvement of commuter rail and NYC residents routinely fake addresses outside of the city to avoid paying city income tax. The house I grew up in happens to sit in “Unincorporated Washington County.” It has a Portland, Oregon, mailing address and sits inside the Beaverton School District, but local job creator Nike threatens to leave the region any time either city talks about annexing the area. Broadly speaking, the way we’ve carved up our metropolitan areas into politically distinct municipalities ensures that suburbanites can enjoy the economic benefits of living near a large city while protecting themselves from having to pay for the social programs that come along with successful cities. It’s a strong claim, but one that’s backed up by the literature.

Two articles came out this week that have me thinking about the issue anew. The first was a piece from the Times, “Lessons From Hurricane Harvey: Houston’s Struggle Is America’s Tale.” The piece is great, and looks at lots of the different factors that made Harvey such a devastating storm for the Houston region. I recommend you read the whole thing, but there’s one piece in it that I’m chewing on this week:

[A county] official… made the point that the area around Houston is a patchwork of counties and municipalities with different rules and no coordination because Texans believed the upside of what became, in essence, institutionalized entropy was that it allowed residents to avoid the encumbrances of city governments, regulations and taxes.

The problem is that hurricanes and floods, worsened by climate change, do not recognize political borders or county lines. Their toll is shared by everyone. The latest estimate from Moody’s puts recovery from Harvey at $81 billion, much of which will end up paid by taxpayers across the United States.

When we talk about Harvey in Houston, we’re not actually just talking about one city with the ability to respond in a coherent fashion to the challenge of climate change and flooding. In fact, the Houston–The Woodlands–Sugar Land metropolitan area is made up of nine counties and 85 different cities (for comparison, the New York metropolitan region has about four times the population and only 133 different cities).

Ever the cynic, for me this boils down to one factor: people moving to Houston for the jobs created by the energy industry created fake political boundaries to make sure their taxes weren’t wasted on poor people and their kids didn’t have to go to public schools with kids that are different from them. As the city has grown over the past 50 years, these divisions have only multiplied as the metropolitan region has spread further and further afield.

While neutering the power of the government is effective at protecting wealth and walling off wealthy communities, it has big implications for how a region responds to a crisis. In the Houston example, it’s unclear whether or not the region will be able to come up with a coherent policy that will reduce the harm from future megastorms. The region has seen a 500-year storm each of the past 3 years, and more are likely to follow. Major resiliency initiatives are needed to ensure that further development takes into account the new realities about changing climate and bigger storms, but when municipalities are competing with one another, that’s unlikely. If one town puts more stringent building or development rules into place, for instance, that’s likely to increase the cost of housing in that area. If those rules are region-wide, avoiding them becomes costly. If, however, the next town over doesn’t implement those rules, development will just shift, completely undermining the new rules. When these small suburban towns are all competing for residents, the likelihood of any pursuing needed reforms is low; it’s game theory 101 all over again.

If Houston is going to have any chance at preparing for and introducing protections against climate change, they’ll have to move in the opposite direction. Political fragmentation and competition between these 85 cities will inevitably result in a metropolitan region in which no player is strong enough to move the region as a whole in a unified direction. Texas prides itself on local autonomy, but challenges such as climate change show how even the wealthy can get burned by lack of any centralized decision-making power.

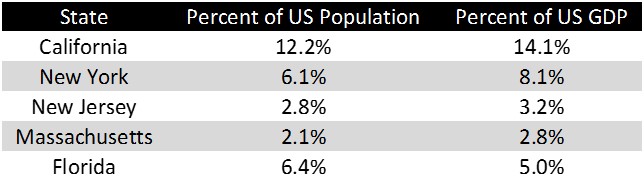

The second piece I’m leaning on comes courtesy of the WSJ’s Editorial Board, “The Great Progressive Tax Escape.” It’s no secret that while I like the reporting at the Journal, I think their Opinion pieces are consistently garbage. This piece is no exception. The piece looks at how wealth in the United States tends to leave high-tax states in which it’s created and migrate into states with lower taxes (IE, Florida). I’m going to leave most of their argument to one side (while they lament New York State, New Jersey, Massachusetts, and California the conveniently ignore that these 4 states create a third of the US’s GDP) and rather take issue with their underlying assumptions. They argue, basically, that high-tax states are engaging in bad policy, because wealthy people are moving their money to places where they won’t be taxed as highly. Doing so is an obvious move for the wealthy, but the Journal’s argument assumes that states are basically interchangeable and that they can compete on equal footing. But these high-tax states are totally different: their share of US GDP is higher than their share of population, while the opposite is true of Florida:

Part of being a productive place is having lots of infrastructure and policy to support a high quality of life and to ensure survival for the lower wage workers necessary in big cities. Florida doesn’t do that (that’s a gross generalization, obviously) and can therefore impose lower taxes. The result is, again, competition between different political areas at the same level. California and New York produce the wealth, while Florida offers “more competitive” (according to the conservative argument) tax rates. In reality, higher taxes often support higher economic output, which Florida can siphon off without paying for.

It’s unclear how we get away from different political bodies being encouraged to “compete” with one another. In the hum-drum every day reality, the poor are locked out when suburbs shut their gates, but Harvey points to how even the wealthy can be bit by political fragmentation. And the Editorial Board at the Journal isn’t helping. As we collectively face the demands that preparing for a changing climate will bring, we will need more cooperation across different levels of government. Arguing for greater competition among states and municipalities will only take us in the wrong direction.

Three days after writing this piece I came upon this section in David Harvey’s Rebel Cities. I’m not re-writing the post or doing any real work to incorporate it, but if I had read it before I would have used it in the piece. Such as it is, here’s a great quote from a great thinker that I’m continuing to chew on:

What Tiebout proposed was a fragmented metropolis in which many jurisdictions would each offer a particular local tax regime and a particular bundle of public goods to prospective residents, who would “vote with their feet” and chose [sic] that particular mix of taxes and services that suited their own needs and preferences. At first glance the proposal seems very attractive. The problem is that the richer you are the more easily you can vote with your feet and pay the entry price of property and land costs. Superior public education may be provided at the cost of high property prices and taxes, but the poor are deprived of access to the superior public education and are condemned to live in a poor jurisdiction with poor public education. The resultant reproduction of class privilege and power through polycentric governance fits neatly into neoliberal class strategies of social reproduction.