Faust, Housing, and Taxes

The tax bill (both the version passed by the Senate and that passed by the House) is garbage. As pretty much everyone has pointed out by now, it points to the utter hypocrisy of the Republican party as embodied in Congress today. Despite years of bitterly complaining about the deficit under Obama, they are now happy to add (in the most optimistic estimate that’s also defensible) a trillion dollars to the deficit. To be clear, that’s more than we added to the deficit in through the American Recovery and Reinvestment Act in 2009. That’s right – the Republicans put up more of a stink about less money being spent when that money was being used to get us out of a recession.

The cynicism of the Republic Party today is truly breath-taking. Krugman’s column from earlier this week is worth a read. Let’s face it – if you’re coming to me for insights into how terrible the bill is you haven’t been paying attention, so I won’t waste your time with general observations.

And yet, despite the awfulness of the bills, the House bill actually gets one part of one topic near to me sort-of right: the mortgage interest deduction. The Senate bill leaves the MID alone completely, and any changes to the MID are likely to fall out in conference, but it’s still leading me down an interesting path of questioning this fall.

The question is this: if a good thing is done for a terrible end, is it a good thing or a bad thing?

Let’s go through the specifics (Edward Pinto has an Op-Ed in the Journal looking at this this week, too – though the precise numbers they give are suspect)

The MID would undermined by the House bill in 3 ways:

- By doubling the standard deduction, fewer people would find that itemizing their tax returns is a profitable strategy, and would therefore stop using the MID at all. Of course, doubling the standard deduction alone would have no negative impact on anyone (except the deficit). If taxpayers are trying to pick the highest of two numbers, one of the numbers going up and the other staying unchanged can’t hurt them.

- Currently, the MID applies on mortgages up to $1 million. The House bill would lower that limit to $500 thousand. While that’s a big jump, the impact would be relatively small – just 6% of mortgages in the US are for more than $500 thousand dollars, so more than 9 out of 10 home-owners wouldn’t be impacted by the lower cap.

- The House bill would also eliminate the use of the MID on second homes. The fact that you can currently deduct the mortgage interest on a second home is completely laughable. Staunch defenders of the MID argue that it’s an important policy because it encourages home ownership (which it doesn’t, by the way), but even by their logic the benefits of federal subsidization don’t exist on second homes.

All told, the House bill has the ability to make an inch of movement toward greater rationality in the housing market. By not artificially inflating housing prices, the weakening of the MID would let families put less money in their homes and more in savings, which could boost the economy – tying up money in a home, which is a completely unproductive asset, doesn’t do any good for anyone.

That’s a good thing.

But, as we claw back subsidies needlessly (and ineffectively) given to the professional / managerial class, the House bill doesn’t propose that we plow that money back into affordable housing, or community redevelopment, or even incentives for developers to build more market-rate housing (in fact, the House bill systematically undermines all those goals through the elimination of the tax exemption of private activity bonds).

Rather, the money saved from the upper middle class will instead be transfered to the über wealthy – the only people that need more money less than the folks who would be hit by the changes to the MID (I’m assuming that if you’re reading this blog, you don’t don’t worship at the altar of trickle-down economic “theory”. It’s been roundly disproved by the data since Reagan first fabricated it in the 80s by economists of all political orientations. I’ll waste no time here arguing against the economic equivalent of a flat-earther).

So I find myself in the very odd position of at once deploring the bill for myriad reasons. It does nothing to actually further the cause of making housing more affordable for most Americans, but it does begin the process of undermining the biggest problem with our tax code vis a vis housing policy.

In the world of politics and pragmatism, this question doesn’t even really make sense: of course something is good, even if it’s part of a package that is generally destructive to the country. After all, if the MID is undermined it’s not likely to ever be reinstated. Reinstating it, after all, would require us to examine it on its merits, a test it’s sure to fail. Even if we get rid of it under a corrupt regime and it’s used to finance theft by the oligarchy, we can always reassign the savings from the MID’s demise to other programs when politicians that care about minority communities and lower-income families are back in power.

But it still doesn’t sit quite right with me. I’m often accused of being too theoretical, and that’s likely happening now. But even though I ought to be cheering the undermining of the MID even as I lament the rest of the tax bill, that’s not the case.

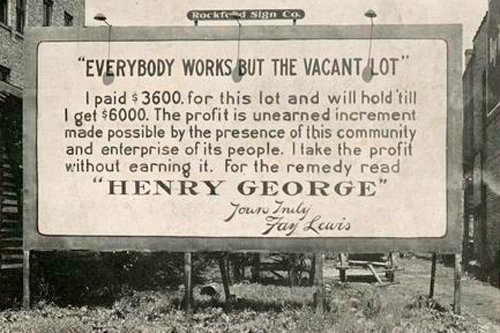

I’ll leave you with a great picture I came across this week. You won’t be surprised to hear it’s one of my favorite things I’ve ever seen on Twitter: