Moving Forward

Since it’s now winter break from NYU, I get to spend the next six weeks doing all the urban history / sociology reading that I don’t have time to do during the semester. The first book on the list is Suleiman Osman’s The Invention of Brownstone Brooklyn: Gentrification and the Search for Authenticity in Postwar New York. I’m enjoying it so far, but one paragraph toward the beginning of the book I particularly liked:

The disintegrated metropolis was a balkanized mess of local fiefdoms run by corrupt machine bosses, myopic homeowners associated, and provincial suburban town halls. In the New York metro area, fourteen hundred overlapping and uncooperative governments formed a labyrinthine bureaucracy incapable of mobilizing its vast resources. In an urban version of the prisoner’s dilemma, the metropolis competed rather than cooperated with itself, resulting in cannibalistic decline rather than mutual growth. “Some of the horrors perpetrated by the absence of central jurisdiction are beyond the power of description to add or detract,” complained real estate investor Robert Futterman. “We have town that dump their sewage into the river used for water supply or recreation by towns downstream…”

A few weeks ago (a month or two, maybe?) I wrote about how the lack of centralized planning capabilities in the Houston region pretty much ensures that they’ll continue to screw themselves over in the face of climate emergencies because no single small town has the power or incentive to take on the task themselves. This summer I wrote about Kim Phillips-Fein’s Fear City: New York’s Fiscal Crisis and the Rise of Austerity Politics and commented on how when areas within the same metropolis compete with one another, we don’t magically get some market-optimal outcome. Suburban municipalities have enough rules and regulations to keep poor people out while remaining close to the central business district. These rules and regulations allow wealthier people to benefit from the economic engine of, say, New York City while avoiding the city’s income tax.

What we get isn’t market efficiency. It’s free-riding, where the wealthy are the ones are riding on the coattails of the less wealthy. In New York City, for instance, the median household income is $55k. For the metro area excluding the city itself, the median household income is a whopping 44% higher. But no one pretends that these suburbs would exist without the engine of New York City.

Here’s where the tax plan comes in – and, more specifically, the rhetoric that’s following its passage. On Wednesday evening, the Wall Street Journal ran an editorial that blared

(To be perfectly honest, I don’t know why I continue to read opinion pieces from the Journal. There’s part of me that wants to engage with and understand the arguments being made by Smart Folks I Disagree With – but over the course of the past year, the opinion writing at the Journal has just totally gone downhill. This isn’t news – many outlets have reported on Rupert Murdoch’s fealty to Trump and the huge number of staff that have quit because of the paper’s insistence on being Trump’s lapdog. Just this week there’s news swirling that the Journal nixed an editorial detailing Trump’s ties to the mob. It’s still sad, though – the Journal has some great reporters that are being buried by Murdoch’s antics.)

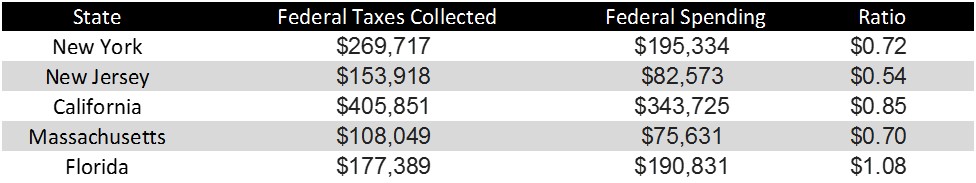

Unsurprisingly, the Editorial Board thinks that thanks to the elimination of the State and Local Tax deduction, states are now going to need to compete with one another on their taxes. Inevitably, they use the example of Florida as a low-tax state to which New York and New Jersey are losing residents, but as always they ignore basic economics: running a high-powered economy demands high taxes for infrastructure and welfare programs. It’s true that taxes in the big economic powerhouse states are higher – but it’s also true that these states are subsidizing the lower-tax states*:

For every dollar that high-tax New Jersey sends to Washington they only get 50 cents. Florida, meanwhile, gets $1.08 for each dollar they send to Washington.

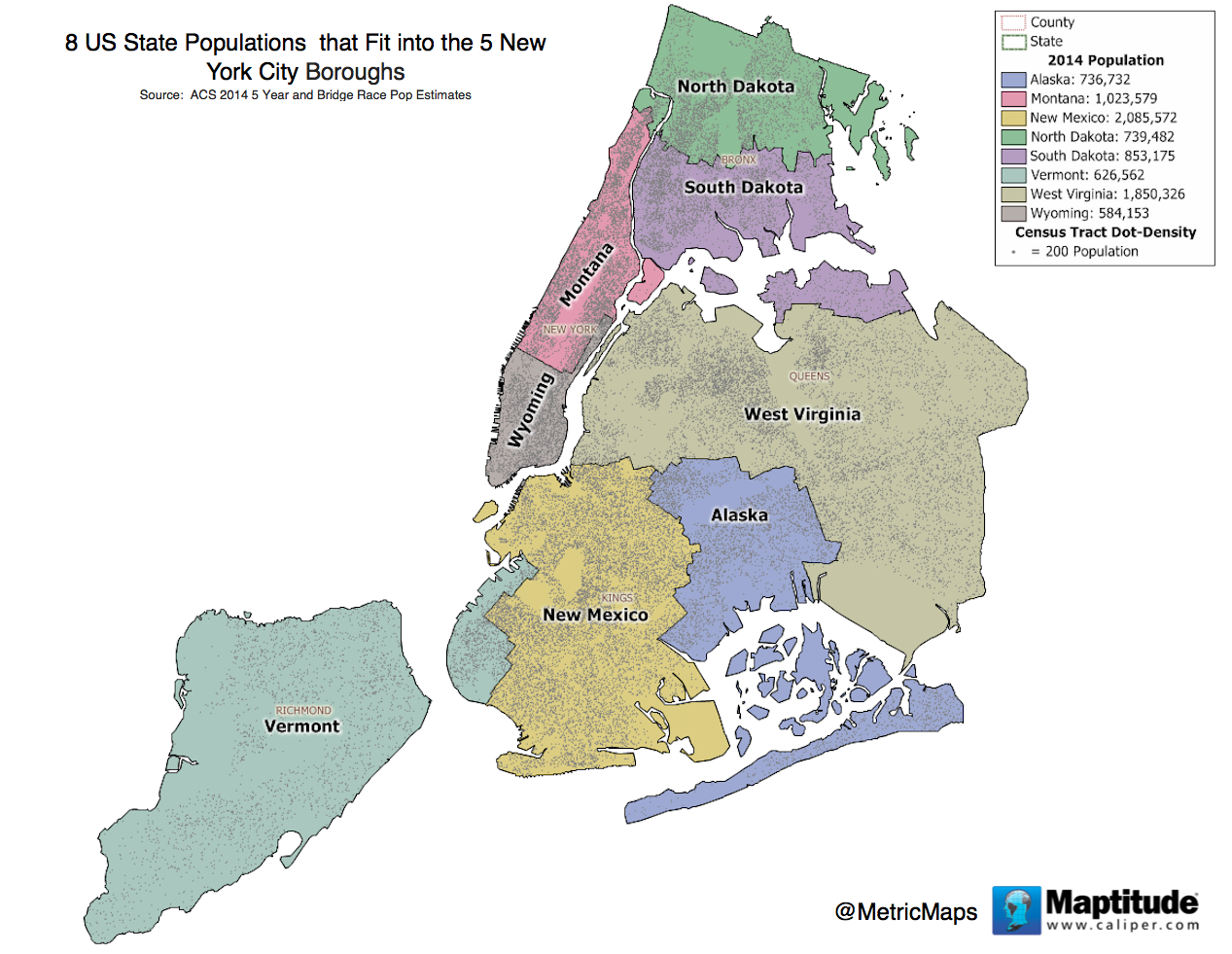

It always surprises me that small-government and pro-growth types don’t howl about this. We’re using the federal government’s purse to subsidize areas that are less productive. We artificially lower the cost of living in areas where people pollute more thanks to driving and sprawl even as we artificially raise the cost of living in areas where economic productivity is highest and carbon emissions are the lowest. Of course, that’s no surprise – it’s built into our system of governance. 39 states have a smaller population than New York City, and thus have two votes in the Senate. Meanwhile, New York City makes up less than half the population of New York State and therefore has less than 1 vote in the senate. Worse, the eight smallest states combined have a smaller population than NYC.

Folks in these states have some 16 times the representation of city residents in Congress’s upper chamber.

Which is all to say that the Wall Street Journal’s argument about high taxes just totally falls apart here. We need higher taxes not only to maintain our outsized productivity, but also because our local spending isn’t being subsidized by the federal government like it is in Florida (and, in fact, 30 other states).

In an effort to make themselves look even dumber, their editorial contradicts their own reporting from earlier this week. Research on how tax increases shows that people are not likely to move out of the state thanks to higher taxes:

Papers co-authored by Mr. Young found tax increases on high earners in New Jersey in 2004 and California in 2005 had little or no effect on how many high-earning taxpayers left those states. Nor did a 1996 tax cut on high-earning Californians spark an inflow of the wealthy.

Anyone who’s taken Economics 101 will tell you that competition happens on two axis: you either offer a better product for a higher price, or you offer the same product for a lower price. California, New York, Massachusetts and other high-tax states are offering a much better product – people are willing to pay for that.

So let’s spare the dramatics. Yes, taxes are going up on the middle- and upper-classes in high-tax states thanks to the abominable, smash-and-grab tax scam that the federal government just passed. And yes, that’s likely to hurt folks like the honchos of the Wall Street Journal who would likely love to see their state taxes cut. But state and local governments shouldn’t cave to the strong-arming by the feds. Taxes in New York, in California, in Massachusetts go to support the things that actually make the economy hum like housing and infrastructure. Cutting those taxes would be an enormous mistake.

*These numbers would be even more skewed if we just looked at cities, but that data is hard to come by. But even within New York State, the City pays much more in state tax than it receives in state expenditures.